Table of contents

Introduction

Nigeria's first mobile-only bank, Kuda Bank, was granted a license by the Central Bank of Nigeria (CBN) in 2019. Consequently, Kuda is only available online and has no physical locations. Babs Ogundeyi and Musty Mustapha founded Kuda Bank. This guide illustrates how to get started with the Kuda Bank App.

We'll go over opening a Kuda account and using the Kuda's fundamental features. Download your app on the Google Playstore store for android devices and Let's get started.

Set Up An Account

By opening a Kuda Account, you will receive various benefits, including a clear visual analysis of your financial transactions and advantages with cards. Here is an overview of the resources that Kuda makes available to you:

Finances

Kuda examines your financial behavior and graphically depicts how your financial patterns have changed over time.

This information helps you identify

- How much income you had.

- How much you spent.

- Your income and expenses laid side-by-side.

- An overview of your expenses by category.

-

You gain superpowers that allow you to spend however you want, whenever you want, and through whatever means you want thanks to a safe, free, and trustworthy transfer process.

-

Save as much as you'd like using a strategy that works for you. To ensure that you don't feel left out, Kuda offers you three different savings plans to suit your needs.

With the help of Kuda, often known as the bank of the free, you can complete all of this with little to no cost. Let's look at how to set up a Kuda account.

Open An Account

Creating an account on Kuda requires a valid email address, a phone number for verification, being over the age of 16, and an optional referral code. Do the following to create your Kuda account:

- Start the app on your mobile device.

- Select "Open An Account."

- Enter a valid email address.

- Enter a password of your choosing.

- Verify your password.

- Enter the referral code (optional).

- An email with an email verification code is sent to the email address you specified.

- Enter the code you received and tap OK.

You will be redirected to a new page where you must enter your personal information into the input fields as follows:

- First name

- Middle name

- Last name

- Gender

- Birthdate

- Telephone number

- Submit Verification code received on your telephone number

- Finally, you must enter your current address

Following this is a "Welcome to Kuda" pop-up. But it doesn't stop there. You will be directed to the login screen, where you must enter your email and password.

Now you're logged into your kuda account. The next step in setting up your kuda account is setting a passcode. A Passcode is a 6-digit code only used to sign in to the kuda app on your mobile device.

When all of this is done you'd have to wait a bit for your account to be created (your account status shows pending till your account has been created).

Verify Identity

Kuda asks you to perform two actions to verify your identity

- Input your valid Bank Verification Number (BVN).

- Record a short video.

Kuda requests for your BVN so they can be sure no one is pretending to be you. When you confirm your BVN, Kuda matches your details with the information on the national BVN database owned by the Central Bank of Nigeria. Other of your account(s) will not be accessed with your BVN. Also, Kuda uses Artificial intelligence to record your face.

Secure Your Account

Kuda will request that you create a transaction pin. Your transaction pin is a 4-digit pin that allows you perform monetary transactions across kuda.

Your transaction pin and your passcode are not the same thing. The former is for performing transactions while the latter is for accessing your kuda dashboard.

More About You

This section focuses on how you intend to use kuda. You could, for example, use kuda for everyday transactions such as savings, debit card, and so on. It also asks questions such as how much you earn and what type of work you do in order to provide you with a wholesome experience when using Kuda Bank.

When the More About You survey is completed, you can access your dashboard and start transacting.

Existing Users

Already existing users don't have to go through the above process as they must have already done that. Existing users can sign in by:

- Launching the kuda app

- Tap sign in

- Input valid email

- Input correct password

- Set passcode

- Confirm passcode

Kuda Features

Having a kuda account equips you with a lot of new and exclusive features that make banking exciting. Here we'll take a closer look at some of Kuda's features.

Kuda Spend

There are numerous payment options available for sending money, purchasing airtime, paying bills, making web payments, and making Point Of Sale (POS) payments. Let's look at how spending is done on Kuda.

Sending Money

When you send money with kuda , money is moved from your account to NIBSS (Nigeria Interbank Settlement Scheme). NIBSS sends responses to Kuda to show if the money has gone through to the receiving bank or not . If the money gets to the receiving bank, it shows up in beneficiary account else kuda reverses the money into your account automatically.

Sending Money With Bank Transfers

Your Kuda account comes with 25 free transfers to other banks every month. Kuda claims that sums up to 15,000 naira saved on transfers every year. Here's how to send money on Kuda with bank transfer

- Launch kuda app

- Tap payments on your dashboard

- Tap send money

- Fill in transfer details of beneficiary account

- Enter transaction pin to confirm transfer

The username option is also available for Kuda to Kuda transfers. Here you simply add in the at sign (@) and the kuda specific username of the beneficiary to make a transfer.

Send money without an account number

Another way to send money for free on Kuda is with a payment link. Any one with a valid kuda account can claim money sent through this method.

- At the bottom of your Kuda dashboard, tap Payments.

- Tap Payment Link.

- Enter the desired donation amount here.

- Make a PIN of four digits.

- Verify your updated payment link.

- Share the payment URL.

Pay online without a debit card

Pay directly from your Kuda account on online stores with Pay ID, no card needed. Below is a video that describes setting up Pay ID:

Receiving Money On Kuda

It is important to note that when money is sent to an account that hasn't upgraded its limit, that account will not be able to receive the money if the transfer amount is above the balance limit. Here's how to go about receiving money:

- Tap add money at the top-right of your dashboard

- Choose the option you'd like to use, we'll use bank transfer here

- On tapping bank transfer we have access to account details plus a option to share

Tap share to send account details which you can use for transfers.

Alternatively;

- Tap on your display name located at the top-left of your dashboard.

- Select copy to copy your account number to your clipboard.

Kuda Save

You have control over your saving as much as you do over your spending. Kuda bank provides 3 options that make saving cash easier.

Spend+Save

This unique feature saves money for you automatically every time you spend on Kuda .You can withdraw at anytime you wish to. Do the following to use Spend+Save:

- Tap savings under your account balance on your Kuda dashboard

- Select Save Now at the top right of the savings screen

- Select Spend+Save then turn on the switch at top right

- Set a percentage you want to spend

Flexible

Kuda Flexible savings allows you save daily, weekly, or monthly toward a goal and get up to 10% annual interest. Create your flexible savings strategy by following the steps given below:

- Tap savings under your account balance on your Kuda dashboard

- Tap Save Now at the top right of the savings screen

- Select Flexible

- Type in your saving goals and tap Next

- Type in how much you'd like to save and tap Next

- Choose how often you want to save; daily, monthly or weekly. Then tap Next

- Set how long you want to save

- Add a picture to your goal

- Review your savings goal, then tap Launch Goal.

- Tap view goals to check your savings progress at anytime.

Fixed

This feature helps you earn annual income while storing a chunk of cash. However, you will lose your interest if you make premature withdrawals from your savings. Start fixed savings like so:

- Tap savings under your account balance on your Kuda dashboard.

- Tap Save Now at the top right of the savings screen.

- Select Fixed.

- Type in your savings goals and type Next.

- Type in how much you'd like to save and tap Next.

- Select how long you want to save for.

- Add a picture to your savings goal.

- Tap view goals to check your savings progress at anytime.

Budget

Keep track of your spending with the use of Kuda budget. Your transactions are classified into various categories. On the Kuda app all of this is free to use. To set a budget:

- Tap budget at the bottom of your dashboard.

- Tap Create A Budget.

- Set the maximum amount you want so spend and select Done.

Borrow

Borrowing money on Kuda is accomplished through an overdraft. A Kuda overdraft is a short-term loan you can take anytime as long as you use your Kuda account frequently. To be eligible for an overdraft you'd need:

- Upgrade your account with your BVN and a valid ID.

- Use your account frequently.

And Kuda automatically offers you an overdraft

Check out how to borrow money on Kuda below

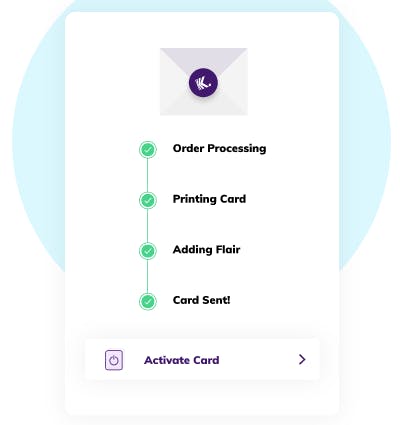

Cards

Managing cards is also made easier as you can order your card right in the app. You can have ownership to a virtual or physical card on kuda.

Physical Kuda Visa Card

A free debit card is delivered to you anywhere in Nigeria with a one-time card issuing fee of 1,000 naira. If your account has been upgraded with BVN and a valid ID you won't have to pay the card issuing fee. You have access to free withdrawals with your kuda card in over 3,000 Automated Teller Machines (ATM).

- Virtual Kuda Visa Card Kuda provides you with a Virtual Naira Visa card which allows you make payments online on anywhere naira visa cards are accepted.

One of the advantages of using the kuda card is the control you have. Say, for example, your physical card gets stolen you can easily block your card on the app.

Getting Help

If ever you need help you can send an email to Kuda here or call 01 633 5832 between 8:00 am and 5:00 pm on weekdays.